Residents reminded to be prepared and secure adequate flood and homeowners insurance

HONOLULU – First Insurance Company of Hawaii (FICOH) reflects on the fifth anniversary of the devastating floods that caused extensive damage to the east sides of Kauai and Oahu in April 2018. Heavy downpours pummeled Kauai and generated flash floods that pushed houses off foundations and made the Hanalei Bridge impassable, cutting the north shore of Kauai off from the rest of the island. In East Oahu, rain fell at a rate of 2 to 4 inches per hour, causing flash flooding that resulted in mudslides, power outages, and hundreds of damaged homes.

In the immediate aftermath of these floods, FICOH received more than 220 National Flood Insurance Program claims, roughly half from Kauai and the remainder on Oahu. A total of 527 properties were impacted by the 2018 floods according to FEMA. Seven homes were destroyed, 110 suffered major damage and 213 received minor damage.

Ahead of this anniversary and National Preparathon Day on April 30, FICOH reminds residents that neither Hurricane nor Homeowners insurance covers water damage caused by tidal surges, overflowing bodies of water, or flash floods. You need Flood insurance for these hazards. Flood insurance can be obtained from the National Flood Insurance Program or private market. The National Flood Insurance Program, NFIP for short, is a federal program that provides flood insurance to individuals and businesses.

Lenders require flood insurance in high-risk flood zones. However, many Hawaii homeowners forego continued flood coverage once their mortgage is paid off, leaving them at risk for uncovered flood damage. According to FEMA, an inch of water is all it takes to cause $25,000 worth of damage to a home.

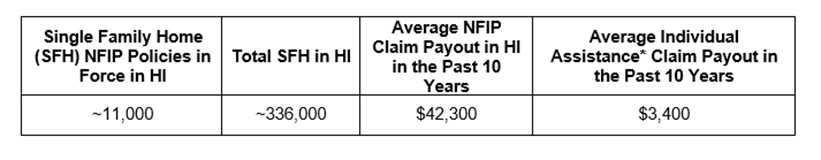

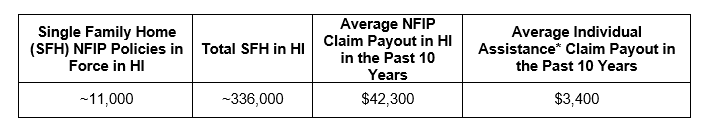

While there are many NFIP policies in force in Hawaii, there are still opportunities to increase participation in the program to improve homeowner and community resilience, as shown in the table below.

* FEMA's Individual Assistance program is designed to help disaster survivors with basic critical needs such as a safe, sanitary, and functional place to live during recovery from a disaster. It is not designed to make survivors whole and is not a substitute for insurance coverage.

According to First Street Foundation, more than 30% of all Hawaii properties are in high-risk flood zones, yet only 5,460 single family homes in high-risk flood zones had NFIP policies in force as of 2022. Add to this the fact that 20% of NFIP flood claims come from properties outside high-risk flood zones and it is apparent that tens of thousands of properties in Hawaii at risk for flooding would be without coverage in the event of a flood.

“Despite floods posing a major and growing threat to Hawaii residents, we’re severely underinsured for flooding as a state,” said Jeff Grimmer, FICOH Vice President. “We urge everyone to educate themselves about their flood risk and ensure they have the insurance protection they need. Doing so will increase our overall resilience as we face more frequent and severe weather events in the future.”

A flood insurance policy from the NFIP normally carries a 30-day waiting period before it becomes active. “Residents should act swiftly,” added Grimmer. “If you wait until right before a major storm, it may already be too late to secure the insurance you need.”

FICOH is Hawaii’s largest writer of Flood insurance through the NFIP. To inquire about flood insurance through the NFIP or private market, contact your independent agent or find an independent agent here.

About First Insurance Company of Hawaii

Founded in 1911, and celebrating its 112th anniversary this year, First Insurance Company of Hawaii, Ltd. is the oldest and largest property and casualty insurer domiciled in Hawaii, with assets of $677 million, liabilities of $423.7 million, and policyholders’ surplus of $253.3 million as of December 31, 2021.

First Insurance, a member of the Tokio Marine North America (TMNA) group of companies, enjoys an “A+” rating from A.M. Best Co. Proud of its broadly experienced, service-oriented staff, First Insurance employs more than 250 insurance professionals and distributes its products through 26 independent general agencies. First Insurance was awarded the American Heart Association’s Workplace Health Gold Achievement for 2022. In 2021, First Insurance was named Hawaii’s number one Best Places to Work in the "large company" category by Hawaii Business magazine.

First Insurance supports many local organizations through monetary donations made at the corporate level, by its associates and the First Insurance Foundation. Its charitable giving focuses on four areas:

1) family, social services and health care; 2) education and career development; 3) environment and sustainability; and 4) civic, culture and the arts.